By the Palm Beach Post Editorial Board

Well, well, well. On the eve of another hurricane season, the insurance industry finally came out and said what almost everyone in Florida expected. Industry experts recently acknowledged that insurers may be forced to raise the property insurance premiums of Sunshine State customers to protect themselves from major storms.

“When most of the modelers are indicating it’s going to be (a) very active season, that’s going to trigger the global reinsurance markets to reassess risk,” Mark Friedlander, the Insurance Information Institute’s spokesman said after Colorado State University released its preseason hurricane forecast and climate’s impact on reinsurance rates.

Uh, duh!

It’s too easy to chastise an industry that’s focused so heavily on fraud and litigation, while the state soft-pedals how the warming climate is impacting storms and the seas surrounding Florida. Last week’s admission, however, could — and should — start a new approach in addressing climate change and providing property insurance.

The Palm Beach Post Editorial Board has urged government officials to think outside the box in developing new ideas. The property insurance industry — instead of just scaling back coverage, dropping customers and hiking premiums as much as 100% — should do the same.

Insurance crisis isn’t exactly news

It’s not like the precariousness of Florida’s insurance market is new. In recent years, the state has seen shifts in the market due to rising claims costs and reinsurance expenses. This has prompted a growing number of homeowners to explore alternative options, including going without coverage.

The property insurance crisis isn’t just a Florida problem, either. One in 13 homeowners across the U.S. is uninsured, according to a recent study by the Consumer Federation of America. For years, government officials and the industry have walled off Florida, leaving it largely to the state and its residents to figure out ways to cope with the risks and the impact of ever-higher insurance premiums. It’s time to admit the crisis is much bigger than Florida.

How can the industry help? Releasing better data on access to coverage and on coverage gaps would be a good start. It’s not like our elected officials, here and elsewhere, have the information that would produce better policies to help homeowners. Rising premiums, an ongoing concern here for tens of thousands of frustrated homeowners from Palm Beach to Pensacola, is a national one that will call for a far wider effort to address than simply passing it off as a “Florida problem.”

Last year, we asked Insurance Information Institute officials how long might it take before our state’s homeowners would see reductions in their premiums. Florida lawmakers after holding two special sessions to address the problems had promised changes within two years. Industry officials weren’t that optimistic.

“Years,” Sean Kevelighan, the institute’s president and CEO said after a brief silence and a bit of prodding.

Litigation, Kevelighan and his colleagues contend, remains the big problem, despite the fact that, after two special sessions of the Florida Legislature in 2022 and again in the 2023 regular session, the industry pretty much got everything it said it needed to reduce the impact of lawsuits, which supposedly would lead to lower rates.

That hasn’t happened.

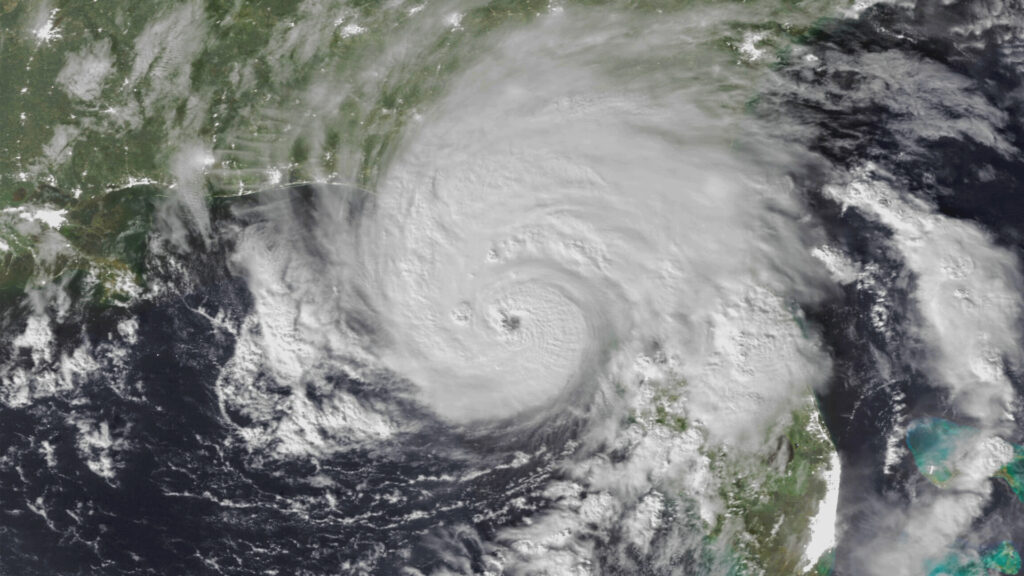

Now the problem is re-insurance, a form of insurance insurers have, to protect them from financial risks. Re-insurers obviously get skittish with the likelihood of any events that threaten payouts. Nerves frayed when Colorado State predicted an extremely high number of storms — 23 named storms compared to the average season of 14 — for the upcoming 2024 hurricane season.

“It is a very ominous forecast, and certainly one of the most significant in terms of potential events that we’ve ever seen in April,” Friedlander said during an interview with WJXT-TV in Jacksonville.

There’s no doubt, at least here in Florida, that the insurance industry has the clout to get the preferred policies that it wants out of government. For years, the industry has gotten its way with the Florida Legislature and the governor’s office, in curbing what many policyholders see as normal remedies in pursuing claims. It shouldn’t take another scary storm-season prediction to get the industry to take both climate change and its customers more seriously.

This opinion piece was originally published by the Palm Beach Post, which is a media partner of The Invading Sea.

If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at nc*****@*au.edu. Sign up for The Invading Sea newsletter by visiting here.