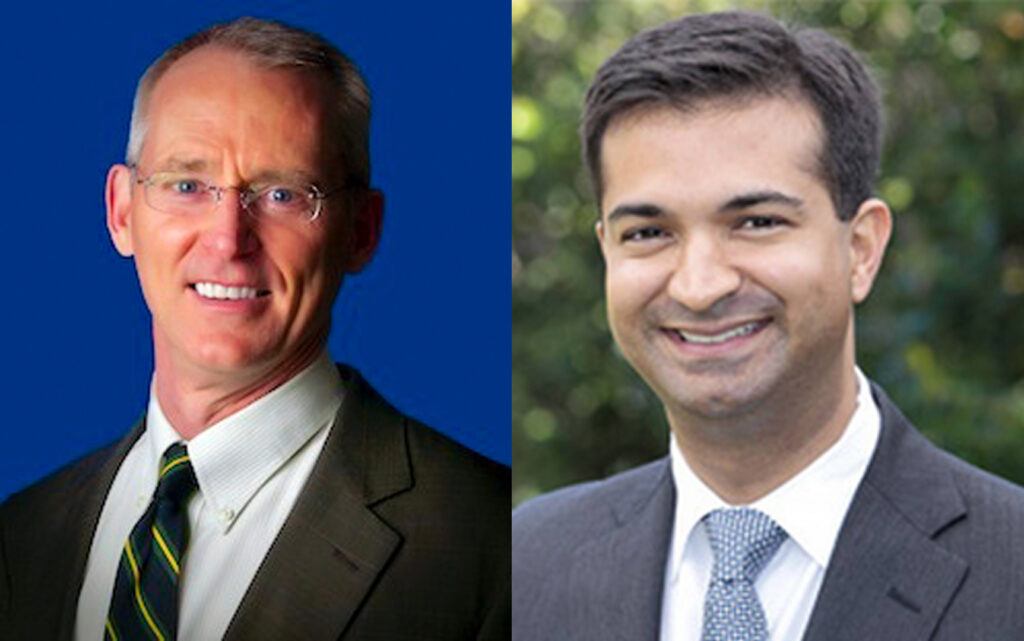

By Bob Inglis and Carlos Curbelo, former U.S. congressmen

Each summer and fall, southern states brace for the destructive force of hurricane season. From Florida to the Carolinas, families face a routine ritual: prepare and pray. But the storms are becoming stronger. The flooding is now more severe, and the economic toll increases every year. In 2024, the United States endured 27 separate weather and climate disasters costing a combined $182.7 billion – one of the costliest years on record.

As former Republican congressmen who represented southern districts in Florida and South Carolina, climate change isn’t abstract. Miami is seeing rising tides. North Carolina has been battered by torrential flooding. Energy grids have buckled under record-breaking heat. These risks are real, and they are reshaping our economy, insurance markets and communities.

That is why conservatives must reclaim the climate conversation. Sadly, today’s debate is too often dominated by the loudest partisan voices. On the far left, some prescribe sweeping mandates and federal micromanagement that threaten innovation and growth. On the far right, others — ironically in the name of conservatism — are turning the tools of government against private companies, punishing them for evaluating the financial impacts of climate risk.

Take Texas Attorney General Ken Paxton’s lawsuit against BlackRock, State Street and Vanguard. He claims these firms formed an “investment cartel” by coordinating their consideration of climate risk, effectively conspiring to disadvantage coal producers and traditional energy companies. But that framing badly misrepresents reality. As the Wall Street Journal editorial board noted, coal production increased during the very period Paxton points to — undermining his claim of an anti-energy conspiracy. What he calls collusion is, in fact, routine fiduciary judgment: investors weighing risks and making portfolio choices. That’s not a cartel. That’s an efficient market working as it should.

Assessing risk, whether from hurricanes, regulation or technological disruption, is the essence of responsible investing. If an asset manager concludes that coastal real estate is more vulnerable to flooding, or that insurance payouts are skyrocketing in certain regions, adjusting portfolios accordingly isn’t “woke capitalism.” It’s their fiduciary duty. It’s to safeguard the value of their portfolios. It’s exactly how free markets are supposed to function.

Some of Texas’s most respected conservative leaders see this clearly. Rick Perry, former governor and energy secretary during the first Trump administration, has criticized Attorney General Paxton’s lawsuit, warning that weaponizing state power against investors undermines the very energy agenda conservatives claim to support. Perry has rightly argued that free markets, not lawsuits and political intimidation, are the best way to ensure American energy security and economic resilience. He argues true freedom means defending the right of businesses and investors to assess risk as they see fit.

Conservatives have long championed the principles of limited government and individual liberty. But when politicians intervene to dictate investment strategies or intimidate firms for recognizing climate risks, they abandon those very principles. The real conservative position is simple: the freedom to invest must be protected. American investors and companies must be able to manage all business risks and opportunities to remain profitable and competitive.

Across the country, center-right voices are beginning to step up and lead on this issue. Institutions like the Cato Institute, the National Taxpayers Union, R Street and federal and state lawmakers are demonstrating how market-based approaches can preserve freedom, drive innovation and prepare our communities for the realities of climate change. We will all convene later this month in New York City to share how conservatives can chart a path forward.

This is not about choosing between the environment and the economy. It is about unleashing American ingenuity to confront financial risks, create opportunities and strengthen resilience. Conservatives should be the ones insisting that the marketplace — not government mandates — decides how to adapt and invest for the future.

The stakes are clear. If we cede the conversation, the public will be left with a false choice between big-government mandates from the left and big-government meddling from the right. Both are wrong. Conservatives must stand for freedom. For families rebuilding after storms, for entrepreneurs developing clean technologies and for investors responsibly assessing risks. Here in America, we must firmly defend the freedom to invest.

Republican Bob Inglis represented South Carolina’s 4th Congressional District from 1993 to 1999 and then again from 2005 until 2011. Carlos Curbelo, also a Republican, represented Florida’s 26th Congressional District from 2015 to 2019. This column first appeared on FoxNews.com. Banner photo: Aerial photo of flooding in South Carolina caused by Hurricane Florence (Senior Airman Megan Floyd/U.S National Guard, Public domain, via Wikimedia Commons).

Sign up for The Invading Sea newsletter by visiting here. To support The Invading Sea, click here to make a donation. If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at nc*****@*au.edu.