By David L Levy, UMass Boston and Rami Kaplan, Tel Aviv University

Another business-led effort to fight climate change is unraveling.

On Aug. 27, the Net-Zero Banking Alliance suspended its activities after several major U.S. and European banks backed out.

While most observers are blaming the strong political backlash in the U.S. against climate change action and sustainable investing, we believe the banks didn’t need much of a push: These net-zero alliances never made much business sense and were not particularly effective at fighting climate change. Indeed, for us the puzzle was why they had flourished in the first place.

To examine their rise and fall, we recently conducted a research project that encompassed interviews with more than 80 executives from various financial institutions, activist organizations and oil and gas companies.

Powerful allies grasped climate risks

The Net-Zero Banking Alliance was founded in 2021. Members agreed to limit lending to carbon-intense sectors so that total greenhouse gas emissions from companies in the banks’ loan portfolios are close to zero by 2050.

This target aligned with the goals of the Paris Agreement but was not binding and lacked clear shorter-term targets and plans. Similar net-zero networks were established for insurance, asset management and other financial areas, all under the umbrella of the United Nations Environment Program’s Finance Initiative. Over the past 16 months, the insurance and asset managers’ alliances have also suspended their activities.

These net-zero alliances were built on the premise that climate risk equals financial risk and that the challenge requires a collective response. Their goal was to leverage the power of finance to push companies to decarbonize their products and processes.

Key financial regulators, central banks and a few of the largest asset managers propelled these alliances because they perceived that climate change poses serious long-term systemic risks to markets and economies around the world. Influential figures such as Larry Fink, the CEO of BlackRock, the world’s largest asset manager, and former Bank of England head Mark Carney, now the prime minister of Canada, lent legitimacy to these initiatives.

Some environmental groups also supported these alliances as a smart strategy to pressure companies on climate. Many other financial institutions then joined the net-zero bandwagon, but our research revealed that they didn’t do so because of concern about climate-related financial risks. Rather, they felt an array of pressure from peers, investors, activists, regulators and even their families.

Many people we interviewed mentioned reputational risk as a key driver and saw a low-carbon transition as inevitable, driven by regulation, technological innovation and consumer demand. This was the Biden era, with billions of dollars flowing to clean energy through the Inflation Reduction Act.

The burgeoning field also spawned a specialized but lucrative industry of data providers and consultants who actively marketed carbon management, disclosure and broader sustainability services. The global market for sustainability data and software was estimated at more than $1 billion in 2024 and growing rapidly.

Climate strategy and sustainability reporting was the fastest-growing business sector for accounting and consulting firms. And asset managers were happy to collect higher fees for funds screened for sustainability – even though these funds have not outperformed the broader market.

These vested interests spurred continued expansion of net-zero networks. Indeed, at its peak in 2024, the Net-Zero Banking Alliance included over 140 members globally with $74 trillion in estimated total assets, representing over 40% of global banking assets.

Political backlash

Given the size and scope of these net-zero networks, what triggered their rapid collapse?

One major factor, of course, was the political backlash against anything connected with climate action and sustainable investing following the 2024 election of President Donald Trump.

Finance officials in more than 20 U.S. states have demanded that major asset managers restrict the use of environment, social and governance benchmarks, accusing them of eroding “traditional fiduciary duty” and claiming they hurt investors.

In August, 23 Republican attorneys general accused organizations created to set standards for corporate climate disclosures of operating an anticompetitive “climate cartel” and violating antitrust laws.

Fossil fuels – too lucrative to abandon

While the political pressure in the U.S. has indeed been intense, the collapse of net-zero networks and the broader corporate retreat from climate commitments is largely due to the continued profitability of fossil fuels and the high costs and risks of deep decarbonization. Investors and banks, of course, want to keep on financing profitable companies and avoid pressuring their clients to take risky measures.

Oil companies such as BP and Shell that had relatively strong climate targets suffered financially as a result, prompting them to retreat from these targets and shift capital from renewable projects back toward fossil fuels. High energy prices in the wake of the Russia-Ukraine war made the sector even more lucrative. Low-carbon fuels and processes for industries such as aviation, steel and cement are still very expensive.

Moreover, the Trump administration is abolishing most subsidies for clean energy and freezing permits for offshore wind, while easing regulations and opening more land for oil and gas exploration.

These economic incentives made it hard for the banking alliance to reduce financing for fossil fuels – and the money has kept on flowing into oil and gas projects.

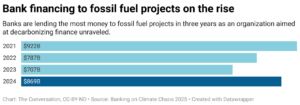

European banks that sharply cut funding to fossil fuel companies saw their business diverted to other banks and to private, nonbank sources of finance, which has soared in the past two years. Facing this loss of business, major banks’ lending to oil and gas companies surged in 2024, driving loans to a three-year high of $869 billion.

The costs of membership in the net-zero alliances also increased over time, with the adoption of stricter standards that called for specific plans and timelines for ending fossil fuel financing entirely. The new standards also required loan recipients to disclose Scope 3 emissions, which include emissions from a company’s suppliers and customers.

Managers in financial institutions told us that the increasingly complex and demanding requirements were generating strong pushback from their clients. We also heard that membership was turning from a reputational asset to a liability, as activist organizations called out the hypocrisy of continued fossil fuel lending despite their commitments to phasing it out.

Ignoring climate change’s long-term risks

Although banks are rushing back to finance fossil fuel projects, these loans typically have long terms of 10 to 25 years. This means they carry the risk that an eventual transition to clean energy will make these projects worthless, “stranded assets.” One study estimates that investors are currently exposed to more than $1 trillion in potential losses.

Why do banks often ignore these risks?

Our interviewees mentioned the organizational silos that separate analysts who assess climate risks from the loan originators. In other words, the employees deciding where to lend money may not be talking to the team that best understands the long-term risks. Moreover, current risk assessment tools are quite crude and don’t generate the quantitative metrics that loan underwriters want.

Finally, loans are increasingly repackaged and sold, or securitized, into the larger corporate debt market, obscuring the risks.

Climate risks are real and growing

The Net-Zero Banking Alliance isn’t disappearing entirely. The group is currently deciding on whether to restructure into a much weaker “framework initiative” that provides voluntary guidance instead of binding commitments.

And some banks leaving the alliance have stated that they will maintain their climate goals and sustainability policies.

But climate risks are real and growing. The Boston Consulting Group recently estimated that just the physical risks – floods, drought and wildfires – could cost companies up to 25% of their profits by 2050 and substantially cut global GDP.

A transition to a low-carbon economy will cost trillions of dollars and create massive disruption – as well as opportunities – as new technologies and companies emerge. The longer that action is delayed, the greater the risks to the planet – and of more drastic shocks to the global economy and financial system.![]()

David L Levy is a professor emeritus of management at UMass Boston and Rami Kaplan is a senior lecturer of sociology and labor studies at Tel Aviv University.

This article is republished from The Conversation under a Creative Commons license. Read the original article. Banner photo: Smoke rises from a Gulf Coast oil refinery (iStock image).

Sign up for The Invading Sea newsletter by visiting here. To support The Invading Sea, click here to make a donation. If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at nc*****@*au.edu.